Overview

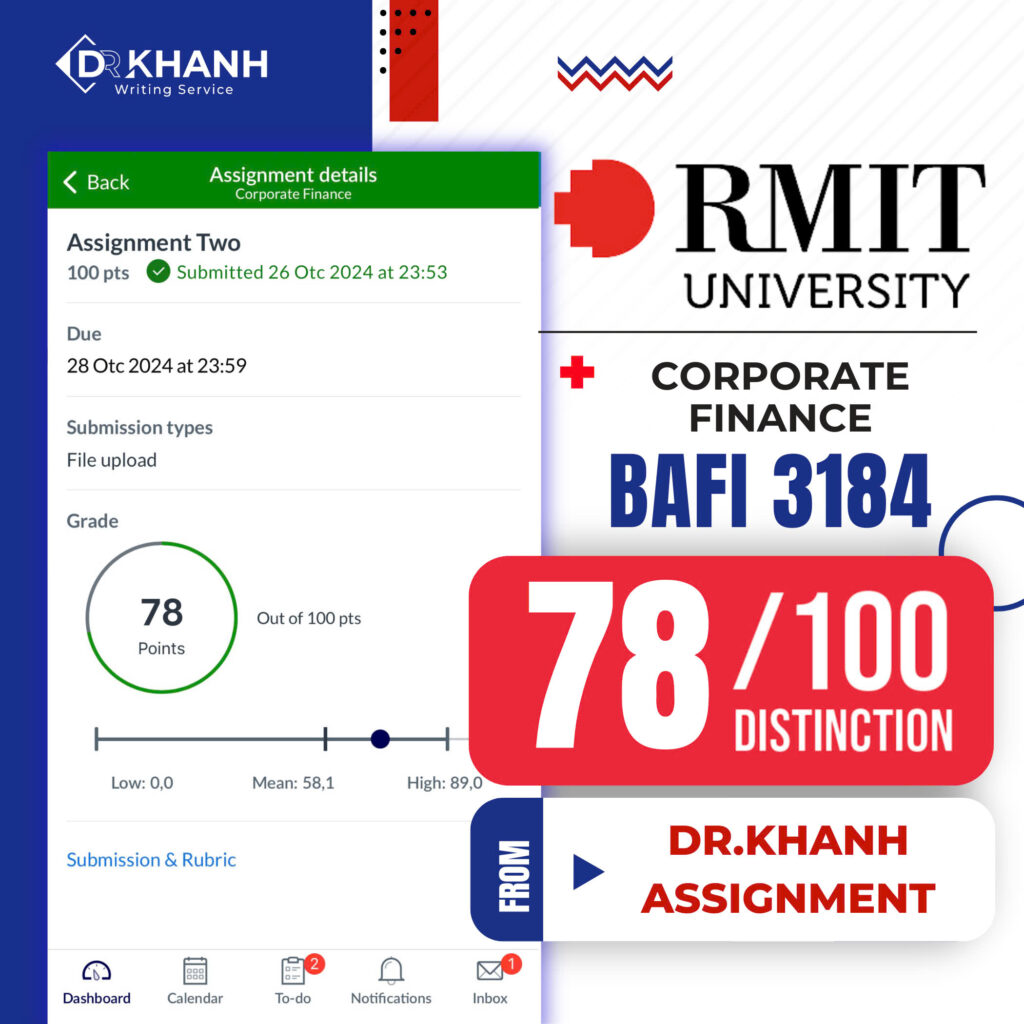

Our client, an international finance student, excelled in the BAFI3184 subject, securing a score of 78/100 on the final project. This remarkable achievement stemmed from the strategic application of advanced valuation models, meticulous analysis, and practical financial insights. Below, we explore how they approached the assignment and leveraged valuation tools to deliver exceptional results.

The Challenge

The BAFI3184 final project required students to conduct an in-depth analysis of Saigon Cargo Service Corporation (SCS). Tasks included:

- Estimating stock valuation using Discounted Dividend Models (DDM) and Relative Valuation approaches.

- Providing a comprehensive risk-return analysis.

- Incorporating current industry trends and financial forecasts.

The complexity of these tasks posed significant challenges, especially for students unfamiliar with combining multiple valuation techniques effectively.

The Solution

Our client utilized the following valuation models, integrated with financial analysis best practices:

1. Dividend Discount Model (DDM)

This model projected SCS’s future dividends to estimate intrinsic stock value. Key steps included:

- Required Return Calculation: Derived using the Capital Asset Pricing Model (CAPM), ensuring realistic assumptions.

- Dividend Growth Rate: A conservative estimate of 3% captured the company’s steady performance.

- Result: The DDM estimated SCS’s stock price at 98,685.58 VND, a 21% upside.

2. Relative Valuation

By benchmarking against six comparable companies in the aviation and logistics sectors, the following metrics were applied:

- EV/Sales: Highlighted revenue efficiency.

- P/E Ratio: Measured profitability per share.

- P/B Ratio: Assessed market value against book value.

Result: A composite stock price of 106,126.81 VND was calculated, indicating a 30% upside.

3. Weighted Valuation

Combining the DDM and Relative Valuation models, the final price of 102,406.19 VND was derived, representing a 25.3% margin of safety from the current price.

The Results

By synthesizing these approaches, the student:

- Earned an HD score of 78+, making him the best performer in his class.

- Delivered a comprehensive analysis lauded for clarity and depth.

- Demonstrated mastery of complex financial tools, positioning themselves as a top performer.

Key Takeaways for Students

- Combine Multiple Models: Use DDM for intrinsic value and Relative Valuation for market-based insights.

- Leverage Financial Benchmarks: Ensure comparability when applying ratios.

- Present Clearly: Structured analysis is as important as accurate calculations.

Free Resources

To support other students, we offer:

- Downloadable Sample: Access the full HD report.

- Valuation Model Template: Download Excel template to streamline your calculations.