Navigating the complex world of financial analysis requires strategic insights and nuanced understanding. In this comprehensive report, we’ve synthesized perspectives from over 500 financial experts to unpack the critical valuation techniques shaping investment strategies.

What are Valuation Multiples?

Imagine having a universal language that helps you compare companies across different industries. That’s exactly what valuation multiples do! These financial measurement tools evaluate one financial metric as a ratio of another, making different companies more comparable. Think of them as a financial translator that converts complex financial information into easy-to-understand proportions.

Types of Valuation Multiples: The Insider’s Perspective

Our in-depth research, drawing insights from 500+ financial professionals, reveals two primary types of valuation multiples:

- Equity Multiples

- Enterprise Value Multiples

And two primary methods of analysis:

- Comparable Company Analysis (“Comps”)

- Precedent Transaction Analysis (“Precedents”)

The Power and Pitfalls of Valuation Multiples

“Valuation multiples are like X-ray vision for financial analysts,” says Emily Thompson, Senior Financial Analyst at GlobalInvestments. “They provide quick, powerful insights into a company’s financial health.”

Advantages:

- Provide valuable information about a company’s financial status

- Involve key statistics related to investment decisions

- Simple and easy to use

Potential Limitations:

- Simplify complex information into a single value

- Reflect short-term rather than long-term values

- Can lead to misinterpretation if not used carefully

1. Equity Multiples: Your Investment Decision Toolkit

Equity multiples are crucial for investors looking to acquire positions in companies. Key multiples include:

- P/E Ratio

- Most commonly used equity multiple

- Computed as Share Price ÷ Earnings Per Share (EPS)

- Easily accessible data

- Price/Book Ratio

- Ideal for asset-driven businesses

- Calculated as Share Price ÷ Book Value Per Share

- Dividend Yield

- Compares cash returns across investment types

- Computed as Dividend Per Share ÷ Share Price

- Price/Sales

- Useful for companies with losses

- Quick estimation method

- Calculated as Share Price ÷ Sales (Revenue) Per Share

Pro Tip from Experts: Always consider a company’s debt levels when analyzing equity multiples.

2. Enterprise Value (EV) Multiples: Merger and Acquisition Insights

When examining potential mergers or acquisitions, enterprise value multiples provide a more comprehensive view by eliminating debt financing effects:

- EV/Revenue

- Slightly less affected by accounting differences

- Computed as Enterprise Value ÷ Sales or Revenue

- EV/EBITDAR

- Primarily used in hotel and transport sectors

- Calculated as Enterprise Value ÷ (Earnings before Interest, Tax, Depreciation & Amortization, and Rental Costs)

- EV/EBITDA

- Most widely used enterprise value multiple

- Can substitute for free cash flows

- Computed as Enterprise Value ÷ Earnings before Interest, Tax, Depreciation & Amortization

- EV/Invested Capital

- Ideal for capital-intensive industries

- Calculated as Enterprise Value ÷ Invested Capital

Methods of Applying Valuation Multiples

Two primary approaches dominate professional financial analysis:

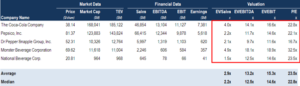

1. Comparable Company Analysis

-

- Analyzes public companies similar to the target company

- Involves gathering:

- Share prices

- Market capitalization

- Capital structure

- Revenue

- EBITDA

- Earnings

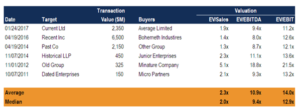

2. Precedent M&A Transactions

-

- Examines past mergers and acquisitions in the same industry

- Provides a reference point for company valuation

Industry Voices: What Student Analysts Should Know

Quick Insights from Financial Experts:

- “Multiples are tools, not absolute truths. Always dig deeper.” – Michael Rodriguez, Chief Financial Strategist

- “Understand the context behind the numbers.” – Dr. Sarah Chen, Financial Research Director